Understanding your customer lifetime value (CLV) is crucial for sustainable business growth. In this comprehensive guide, we’ll walk you through everything you need to know about calculating and optimizing CLV to drive your business forward.

Learn how modern CRM solutions help business & transform your customer value tracking and help you make data-driven decisions that impact your bottom line.

What is Customer Lifetime Value and Why Does It Matter?

Customer Lifetime Value represents the total revenue a business can expect from a single customer account throughout the business relationship. Think of it as looking into the future of your customer relationships – not just what they’re worth today, but their potential value over time.

Consider this: acquiring a new customer costs five times more than retaining an existing one. By understanding your CLV, you can:

- Make informed decisions about customer acquisition costs

- Identify your most valuable customer segments

- Allocate resources more effectively

- Develop targeted retention strategies

The Essential CLV Formula: Breaking Down the Numbers

The basic formula for calculating Customer Lifetime Value is:

CLV = Average Purchase Value × Average Purchase Frequency × Average Customer Lifespan

Let’s break this down with a real-world example:

Imagine you run a subscription-based software company:

- Average monthly subscription: $50

- Average customer stays subscribed: 24 months

- Average additional services purchased per year: $200

Your CLV calculation would be: ($50 × 24) + ($200 × 2) = $1,600

However, for more accurate results, you should also factor in:

- Customer acquisition costs (CAC)

- Operating costs

- Discount rates

- Customer service expenses

Advanced CLV Calculations: Understanding Historical and Predictive Methods

Historical CLV Method: Looking at Past Performance

The Historical CLV Method relies on actual customer data to calculate lifetime value. This method provides concrete insights based on real purchasing behavior and customer interactions. Here’s a detailed breakdown of how it works:

1.Data Collection and Analysis

- Gather all historical purchase data for each customer

- Include transaction amounts, dates, and frequency

- Record all customer service interactions

- Track product returns and complaints

- Document loyalty program participation

2. Cost Calculation

- Calculate total customer acquisition costs

- Include marketing expenses allocated per customer

- Factor in customer service costs

- Account for product or service delivery expenses

- Consider overhead costs per customer

3. Revenue Analysis

- Sum all purchases and recurring revenue

- Include upsells and cross-sells

- Calculate average order value

- Determine purchase frequency patterns

- Evaluate seasonal buying trends

4. Profitability Assessment

- Apply relevant profit margins

- Subtract all associated costs

- Consider discount rates

- Account for inflation

- Calculate net present value (NPV)

Predictive CLV Method: Forecasting Future Value

The Predictive CLV Method uses advanced analytics and machine learning to forecast future customer behavior and value. This forward-looking approach helps businesses make proactive decisions about customer relationships.

1. Behavioral Analysis

- Study customer engagement patterns

- Analyze website interaction data

- Track email response rates

- Monitor social media engagement

- Evaluate customer feedback and surveys

2. Predictive Modeling

- Use regression analysis for purchase predictions

- Apply machine learning algorithms

- Consider market trends and seasonality

- Factor in industry growth rates

- Include competitive analysis data

3. Risk Assessment

- Calculate churn probability

- Identify potential upsell opportunities

- Evaluate market conditions

- Consider economic factors

- Assess competitive threats

4. Value Projection

- Create multiple scenario forecasts

- Use probability-weighted outcomes

- Consider customer segment variations

- Account for product lifecycle stages

- Factor in market evolution

Comprehensive Strategies to Increase Customer Lifetime Value

1. Enhanced Customer Experience and Personalization

Create a seamless customer journey that encourages long-term loyalty:

- Implement AI-driven personalization across all touchpoints

- Develop custom communication strategies for different segments

- Create personalized product recommendations based on purchase history

- Design targeted content marketing campaigns

- Offer customized loyalty programs based on customer behavior

2. Strategic Upselling and Cross-selling

Maximize revenue through thoughtful product suggestions:

- Analyze purchase patterns to identify optimal upsell timing

- Create complementary product bundles

- Develop value-added service packages

- Implement predictive analytics for product recommendations

- Design tiered pricing strategies

3. Proactive Customer Success Programs

Build a robust customer success framework:

- Establish dedicated customer success teams

- Create onboarding programs for new customers

- Develop regular check-in schedules

- Provide product training and education

- Offer premium support options

4. Data-Driven Retention Strategies

Use analytics to prevent churn and strengthen relationships:

- Implement early warning systems for at-risk customers

- Create automated re-engagement campaigns

- Develop win-back programs for dormant accounts

- Design loyalty rewards based on customer behavior

- Build referral programs for existing customers

5. Value-Added Services

Enhance your core offering with additional benefits:

- Create premium support tiers

- Offer exclusive access to new features

- Develop educational resources

- Provide consulting services

- Host customer events and webinars

6. Customer Feedback Integration

Build a continuous improvement cycle:

- Establish regular feedback collection methods

- Create customer advisory boards

- Implement suggestion tracking systems

- Develop rapid response protocols

- Share product roadmaps with customers

Conclusion: Transform Your Business with CLV Insights

Understanding and optimizing customer lifetime value is essential for sustainable business growth. With the right CRM solution, you can turn CLV insights into actionable CRM strategies that drive revenue and build lasting customer relationships.

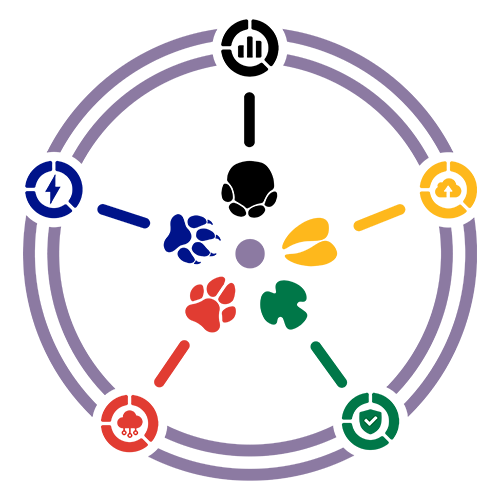

Big Five CRM offers powerful tools to help you implement both historical and predictive CLV tracking, along with comprehensive features to support all your customer value optimization strategies. Our no-code solution makes it easy to get started, with features designed specifically for growing businesses.

Ready to maximize your customer lifetime value?

Start your free trial with Big Five CRM today and access our complete suite of CLV optimization tools. Also get help from CRM integrations services from a reputed agency to get most out of it.